Wouldn’t it be good to reach net-zero this year? While there is no bad time to improve the energy efficiency of your home, 2024 has never been better. The cost of utilities has never been higher—but the cost of energy improvements has never been lower.

For starters, you can get thousands of dollars in federal grant money to save energy. And an additional 10-20% is usually available for low-income communities.

Clean energy helps the environment—utilities are a huge source of emissions. It is so much safer to have all that carbon out of the air.

Plus, you can save all kinds of money on utilities in addition to having a more valuable house.

Look at your last power bill. Think of what you can do with that money.

Here are four funded ways to save money on energy in your house.

1. Whole Home Energy Audit

Those who are just getting started can begin by identifying major areas of improvement. How much money could you save by installing solar panels? Are there major areas of energy loss? A home energy audit will help you know.

The IRA offers 30% tax credit or $150 for an energy audit. Also, the HOMES Act offers a results-based rebate.

You can get 50% (up to $4,000) of your project costs back if you save 35% on home energy, or up to $2,000 if you save less energy.

For low-income homes, these rates are doubled to pay up to 80% of the project costs.

2. Rooftop Solar and Battery Installation

Solar and battery systems produce zero-emissions electricity for free in your house. They also help protect your home from energy price fluctuations, and guard against power outages.

The IRA offers a 30% uncapped tax credit for rooftop solar, a 30% uncapped tax credit for electrical panel upgrade if in conjunction with rooftop solar, and a 30% uncapped tax credit for battery storage. It is available now!

A typical solar system costs $15,000 to $20,000, so this credit will be worth $4,500 to $6,000.

3. Electric Panel Upgrade

Efficiency estimates tend to assume modern electrical infrastructure in your house. To ensure the benefits of any electrification project, check your panel during your energy audit–some of the upgrades listed here may actually require it.

There is a $600 federal tax credit for panel upgrades that are not part of a solar installation project, or a 30% uncapped tax credit if they are part of a solar installation project. Beginning in 2024, the IRA will provide up to $4,000 for wiring upgrades and $2,500 for panel upgrades for low- and moderate-income households.

4. Weatherization

Fixing the insulation of doors, walls, and windows, as well as ventilation improvements, adapts the house to the weather. This is one of the first things any home energy audit will address.

Insulation can be the biggest source of lost energy in a house—some homes can save 20%-35% on energy bills simply by repairing energy loss points.

The IRA offers a 30% tax credit up to $1,200 per year for weatherization projects, with smaller caps on specific items. Beginning in 2024, it will offer $1,600 for weatherization in low- and moderate-income households.

5. New Appliances

Part of the well-heralded IRA is the HEEHRA (stands for High-Efficiency Electric Home Rebate Act). Beginning in 2024, it will give low-to moderate-income households incentives to improve energy efficiency through weatherizing, panel upgrades and new appliances.

It allocates up to $14,000 per low and moderate income households’ efficiency improvements. It will pay up to 100% of the energy upgrades for low-income (<80% of local median income) households and up to 50% for middle-income (80%-150% of local median income) households.

Rewiring America has produced a calculator to help you decide what to replace. It is at https://www.rewiringamerica.org/app/ira-calculator .

Still feeling stuck with an inefficient, outdated home energy system, or are you interested in learning more?

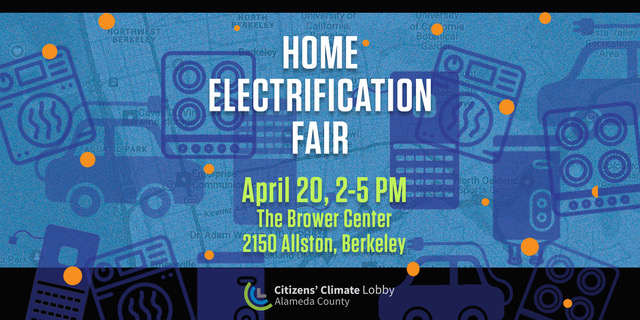

Come to the Electrification Fair!

It is a great place to learn about:

- Getting started

- Specific appliances

- Unusual houses

- Industry experts and trusted contractors

- Tax breaks and financial incentives

Admission is free. Sign up below.

https://cclalameda.org/electrification-fair-2024/

On April 20, CCL Alameda and CASA (Community Action for a Sustainable Alameda) will host a free event to help answer any questions you may have about electrifying your home. Please click the link above to learn more.

Leave a Reply